Initiatives

related to

climate change

Disclosures Based on TCFD Recommendations

In line with our corporate philosophy, “Always Bright and Friendly,” the Meiwa Group conducts business to contribute widely to society. We do this by creating a warmhearted organization where all employees encourage each other to embrace the principle of teamwork while showing integrity and truthfulness in all that they do. In 2021, we established our Basic Sustainability Policy, recognizing that addressing sustainability is important for management and has the potential to create new opportunities for profit.

Based on this policy, we will disclose information about the risks and opportunities associated with climate change, using the framework of the TCFD recommendations.

Governance

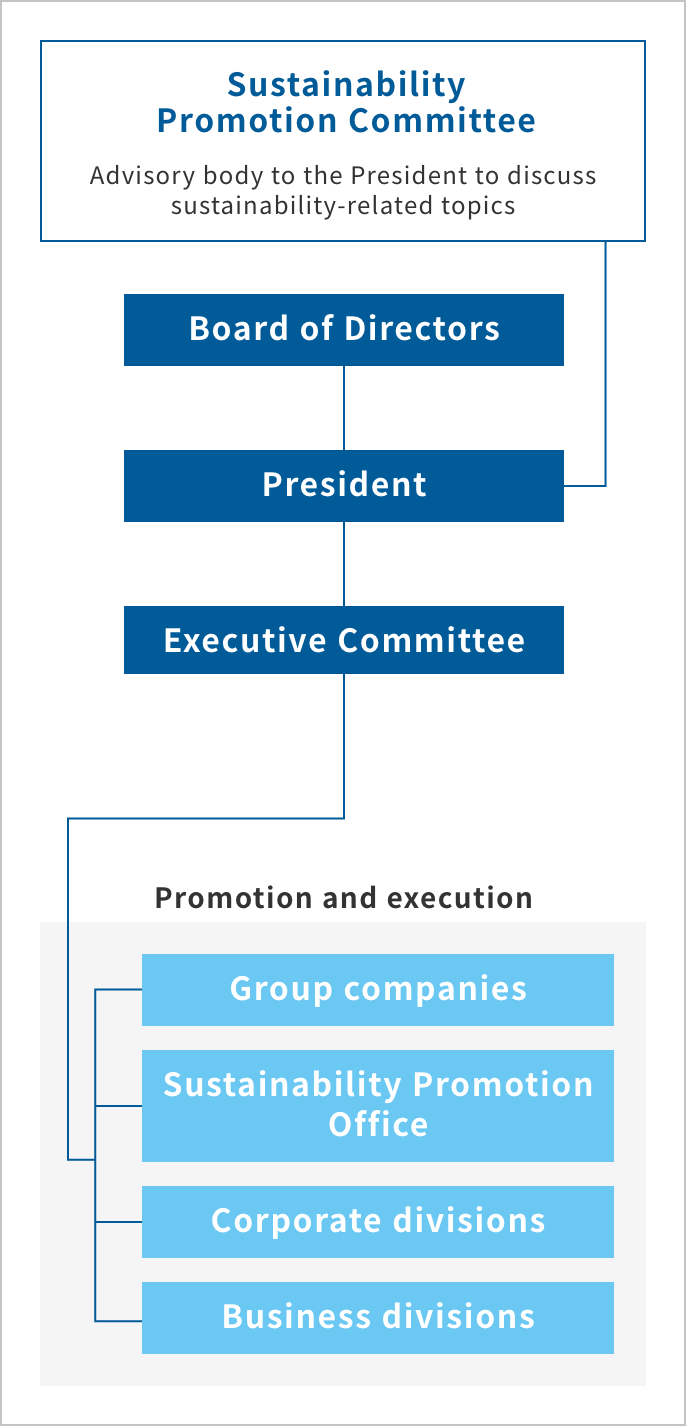

In February 2022, the Meiwa Group established a Sustainability Promotion Committee as an advisory body to the president along with a corresponding Sustainability Promotion Office. The president is responsible for spearheading the initiative to proactively and aggressively address the challenges of sustainability, including actions related to climate change, as risk and profit opportunities, in order to boost our corporate value.

The Committee is headed by the director in charge of Corporate Affairs and discusses sustainability policies, issues, and actions. The Committee reports to the Board of Directors, which provides oversight by deliberating on and reaching decisions on important issues.

Strategy

At the Meiwa Group, we see the various risks and opportunities associated with climate change as essential for formulating effective business strategies. Noting that the effects of climate change might become apparent over the medium to long term, the Group considers both short-term and medium- to long-term views.

-

Scenario Analysis

When conducting a climate scenario analysis, we recognize the importance of anticipating and preparing for several situations. For this reason, we consulted the United Nations Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA) and used their under 2°C increase and 4°C increase scenarios.

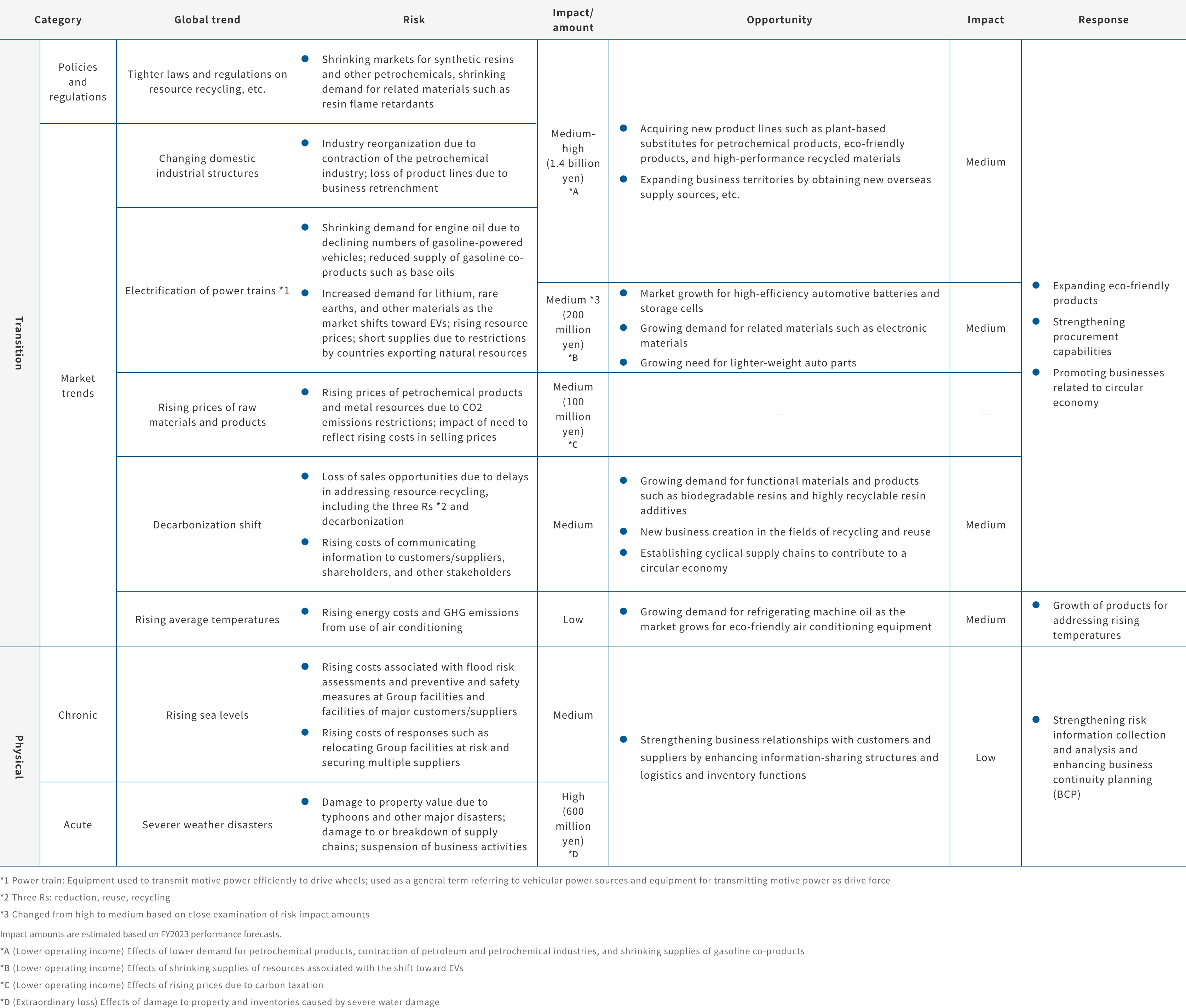

The resulting analysis of risks and opportunities considers both the transitional aspects from social changes driven by policies and technologies as well as the physical aspects that result from natural disasters and rising temperatures.*Assumptions

Scenario analysis covers Meiwa Corporation and consolidated subsidiaries (all businesses).Scenario Timeframe Reference scenarios Under 2°C Transition Medium term (2030) Climate change projection scenario SSP1-2.6 by the IPCC (6th Assessment Report), Transition scenario Sustainable Development Scenario (SDS) by the IEA (IEA WEO2020) 4°C Physical Long term (2050) Climate change projection scenario SSP5-8.5 by the IPCC (6th Assessment Report) -

Scenario Analysis Process

For climate scenario analyses, we examined the changes in the global and external environment that could be expected under these scenarios. For each business division, we considered the likelihood, frequency, and impact of the events that could occur under each scenario based on certain parameters, then we identified the risks and opportunities through discussions.

Later, we evaluate the impact of each risk and opportunity on the Meiwa Group’s overall earnings and business continuity, identifying those that are significant as risks and opportunities to be disclosed at this time.

We also calculated the financial impact of the risks identified using internal projections based on our business configuration and external parameters published by international organizations and other sources. We will consider how to deal with the financial impact of opportunities by incorporating them into future business strategies. -

Meiwa Group risks, opportunities, and responses

-

Responding to risks and opportunities

The President and the Board of Directors will deliberate on responses to the risks and opportunities identified above and incorporate them into strategies in a timely manner, and we will strive to implement the responses through the Executive Committee. The Sustainability Promotion Committee will monitor the progress of responses and their validity in light of changes in internal and external circumstances.

Risk Management

In managing risks associated with climate change, the Meiwa Group, with the Sustainability Promotion Committee playing a central role, identifies and assesses risks with potential major impacts on its businesses in light of changing internal and external circumstances, and reports them to the President and the Board of Directors.

Risks identified are responded to by the sections responsible (business divisions and corporate divisions) according to internal rules such as the basic rules on risk management and rules on division of responsibilities. Oversight and management are carried out by the Board of Directors, Executive Committee, or other bodies in accordance with the nature of individual risks.

The Sustainability Promotion Committee monitors the state of Groupwide initiatives and reports regularly (at least once a year) to the President and the Board of Directors. In this way, we respond to risks associated with climate change from a long-term perspective by revising business strategies as appropriate and in other ways.

Indicators and Targets

Recognizing curbing global warming to be an important social issue, the Meiwa Group has expanded the scope of grasping emission amounts to include consolidated subsidiaries to promote related efforts.

While the Group does not currently set specific targets for Scope 1 and 2 GHG emissions as the levels thereof should be minor in light of our business configuration, we will maintain efforts Groupwide to reduce GHG emissions and contribute to a decarbonized society.

GHG Emissions

| FY 2020 | FY 2021 | FY 2022 | |

|---|---|---|---|

| Scope1,2 (t-CO2) |

512.8 | 419.6 | 430.4 |

(1) GHG emissions are calculated with reference to World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD).

(2) The scope of calculations includes Meiwa Corporation on a nonconsolidated basis as well as consolidated subsidiaries.

(3) GHG emissions rose in FY2022 due to the addition of a consolidated subsidiary (AQEA Corporation).

Note on forward-looking statements

The analytical results and projections presented on this material are based on information available at the time of their publication. Actual results, outcomes, performance, and other details may differ significantly due to various risks and uncertainties, including economic trends, market prices, and exchange rates.